NUCFDC Launches Sahakar Digipay and Sahakar Digiloan to Boost Digital Banking for Urban Co-op Banks

Strengthening Digital Transformation Across the Urban Co-operative Banking Sector

New Delhi | 10 November 2025: NUCFDC launches Sahakar Digipay and Sahakar Digiloan — two innovative digital platforms designed to enhance digital banking and lending capabilities of Urban Co-operative Banks (UCBs) across India.

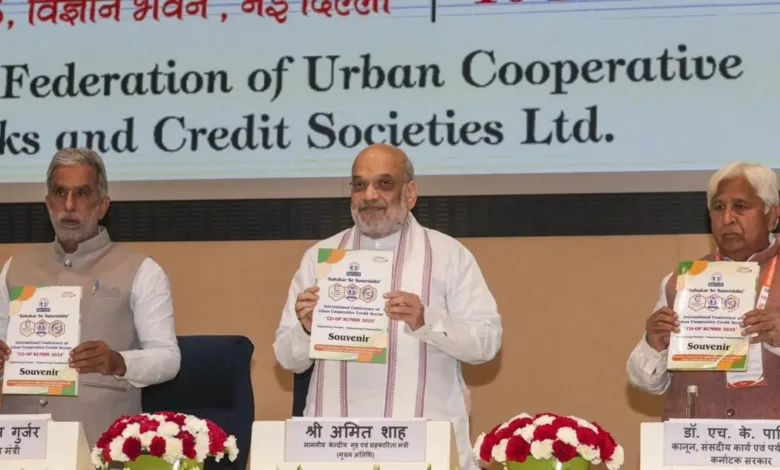

The launch, led by Shri Amit Shah, Union Home Minister and Minister of Cooperation, took place at Co-op Kumbh 2025. These new products represent a key milestone in NUCFDC’s mission to modernize the UCB sector, promote financial inclusion, and empower banks with secure, scalable, and affordable digital tools.

Driving Digital Innovation in Urban Co-operative Banks

The National Urban Co-operative Finance and Development Corporation (NUCFDC), the umbrella organization for UCBs, developed these platforms to help banks streamline payments and automate lending operations.

Sahakar Digipay focuses on creating a centralized, cost-efficient digital payments infrastructure, while Sahakar Digiloan accelerates paperless lending and credit processing. Together, they aim to help Urban Co-operative Banks compete with mainstream financial institutions by becoming more efficient, transparent, and tech-driven.

Aligned with the Government’s Vision of Digital Empowerment

Unveiled under the guidance of Shri Amit Shah, the digital solutions align with the government’s broader vision of building digitally empowered and sustainable co-operative banks.

Both platforms are designed to serve India’s new generation of customers who expect quick, reliable, and digital-first banking experiences.

Leaders Highlight the Impact of the Launch

Empowering Over 1,400 UCBs Nationwide

Shri Jyotindra Mehta, Chairman of NUCFDC, emphasized the importance of digital readiness for UCBs:

“India’s 1,400-plus Urban Co-operative Banks serve more than 9 crore customers through nearly 11,500 branches. While they are key to financial inclusion, many still face challenges in adopting secure and scalable digital systems. The new products bridge this gap by offering affordable, future-ready solutions that boost governance and service delivery.”

He added that the initiative will help UCBs deliver faster, smarter, and more secure financial services, ensuring their self-reliance and growth.

Simplifying Digital Transformation for the Sector

Shri Prabhat Chaturvedi, CEO of NUCFDC, highlighted how the products will reshape operations:

“Each solution addresses a specific operational challenge. They reduce manual processes, improve turnaround time, and strengthen compliance. These innovations mark a decisive step toward building confidence and digital resilience among UCBs.”

He described the launch as a major milestone in the digital evolution of India’s co-operative banking ecosystem.

Sahakar Digipay: A Centralized, Secure Payments Platform

Sahakar Digipay by NUCFDC is a centralized UPI switch built to reduce transaction costs for Urban Co-operative Banks. It integrates advanced fraud detection and risk management tools, ensuring secure, compliant, and efficient digital transactions.

This solution empowers UCBs to offer UPI-based payments at lower costs, while maintaining transparency and customer trust.

Sahakar Digiloan: Paperless, Automated Lending for Faster Approvals

Sahakar Digiloan is a Loan Origination System (LOS) that digitizes the entire lending process — from onboarding to approval. It includes features such as:

- Digital KYC and Paperless Applications

- Automated Credit Assessment

- Real-time Risk Identification

With these capabilities, banks can process loans faster and ensure transparent credit delivery. The platform promotes data-driven decision-making, helping UCBs strengthen both retail and commercial lending operations.

Building the Future of Urban Co-operative Banking

With NUCFDC launches Sahakar Digipay and Sahakar Digiloan, the organization has taken a significant step toward digital empowerment and operational excellence for Urban Co-operative Banks.

By adopting these solutions, UCBs can enhance efficiency, reduce costs, and deliver smarter, more reliable financial services — advancing India’s vision of a modern, inclusive, and digitally resilient financial system.

Also Read : NSDL Unveils New FPI-FVCI Portal to Simplify Market Entry for Global Investors